san francisco payroll tax withholding

This can sometimes take several weeksthe sooner you start the process the sooner. Payroll is a part of HR OperationsOur responsiblitiesSet Up and Maintainance of Employee Pay Data.

Salary Paycheck Calculator How Do You Calculate Your Take Home Pay Marca

UCSF employees now use UCPath online to complete and submit tax forms.

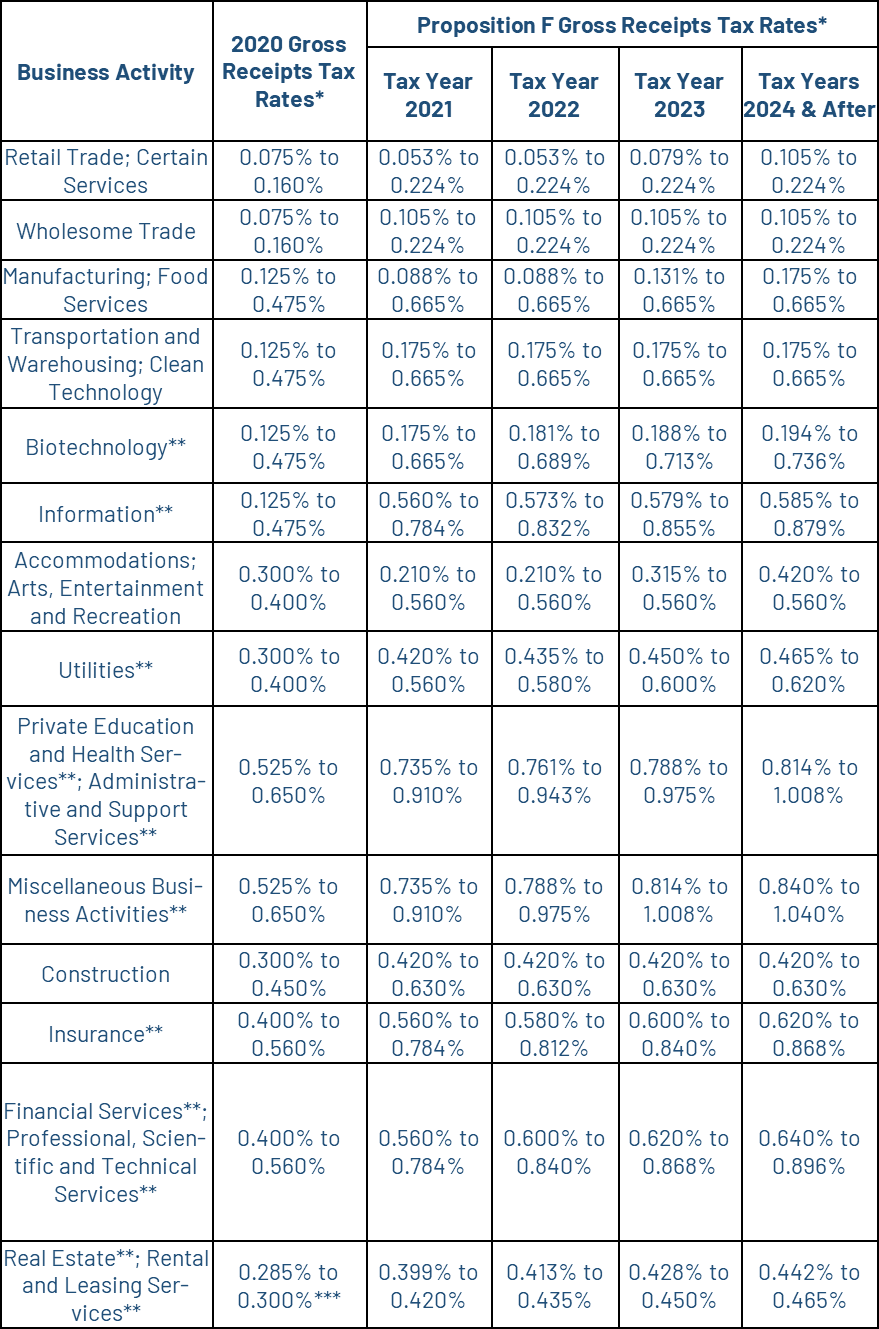

. The San Francisco Superior Court has eliminated 50 million in outstanding debt for people who owe civil assessments 300 late fees charged by traffic court when people miss a deadline. Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments.

Some of the zip codes included are. Social Security 62 if applicable to annual maximum earnings of. The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses.

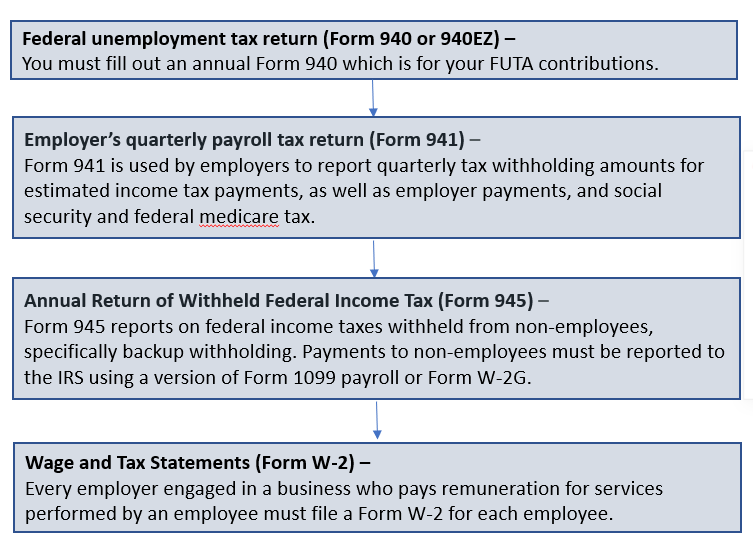

Federal and State tax. The Gross Receipts Tax is a graduated percentage depending on the activity code your business falls under in the NAICS system. The federal income tax is meant to be paid throughout the year.

See below for a complete list of 2021 Payroll taxes for each zip code in San. Withholding on supplemental wage. Medicare tax 145 if applicable.

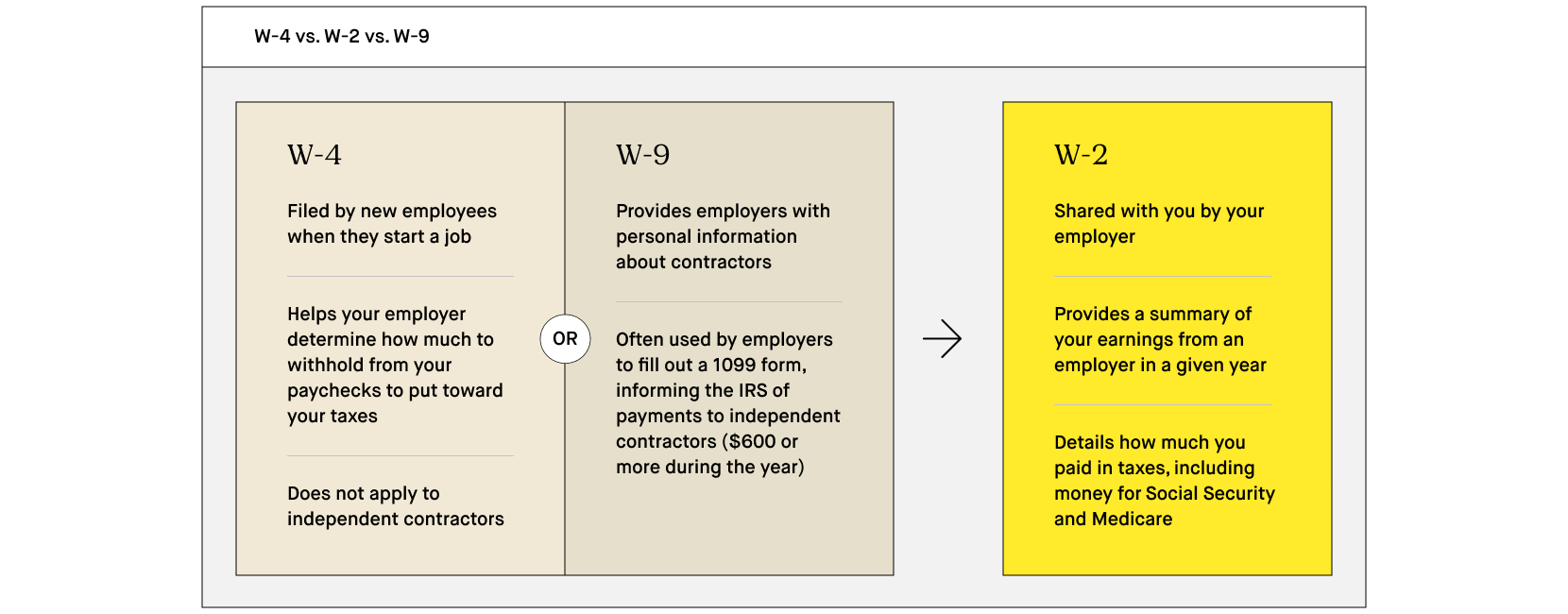

Proposition F fully repeals the Payroll Expense. If you do not pay the Income Tax through withholding or do not pay enough you may be asked to pay an. California employers use both IRS Form W-4 and state Form DE 4 for California personal income tax PIT withholding.

The power to control the decision-making process by which. Form W-4 tells payroll processors how much tax to withhold from employee paychecks based on their filing status and how many allowances they claim. Effective January 1 2022 businesses subject to the San Francisco Administrative Office Tax AOT must pay an additional annual Overpaid Executive Tax OET of 04 to 24.

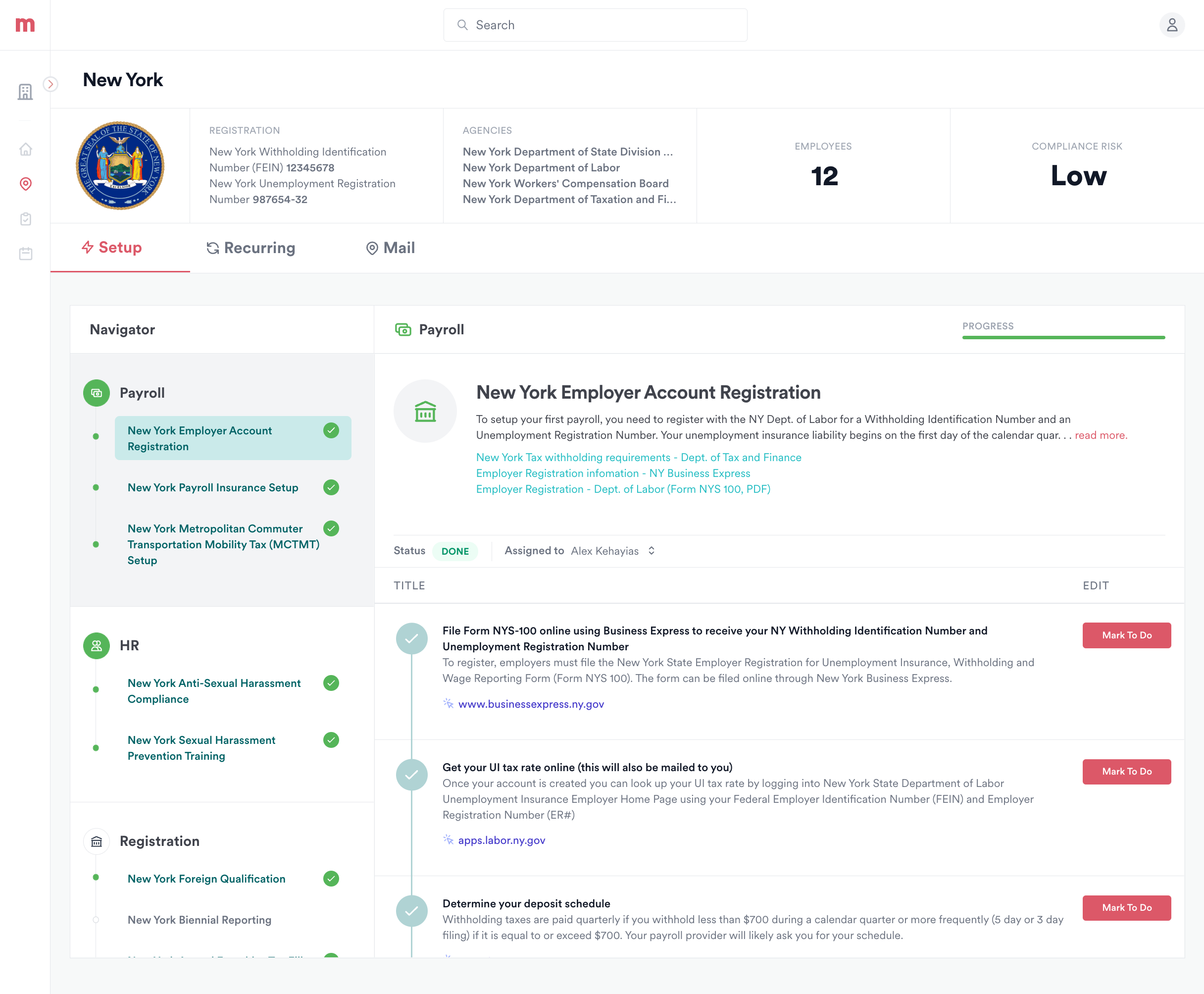

The key to liability for payroll taxes under Section 6672 is control of finances within the employer corporation. Before you can pay employees make sure youve registered for payroll in their applicable work state. Keeping good records can also help you monitor.

Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax. The IRS requires that you keep records of employment taxes for at least four years. Entities currently paying a payroll tax under the alternative administrative office taxing regime also are subject to an additional payroll tax of 15.

See Employee Withholding Forms. Gross Receipts Tax and Payroll Expense Tax. 94102 94103 94104 94105 94106 94107 94108 94109 94110 and 94101.

Personal data job data federal state tax information general and benefit deductions. Nonresidents who work in San Francisco. In November of 2020 San Francisco voted to.

Set Up a Payroll System to Withhold Taxes. Apply to Payroll Manager Tax Manager Senior Payroll Accountant and more. Review the Update My Federal Withholding W-4 and Update My California Tax Withholding DE-4 software.

Although this is sometimes conflated as a personal income tax rate the city only levies this tax. Lean more on how to submit these installments online to. For entities and combined.

California Economy Warning Signs On Tech Calmatters

Gross Receipts Tax Gr Treasurer Tax Collector

Fringe Benefits Rules For 2 S Corp Shareholders Cares Act Changes

W 4 Form What It Is How To Fill It Out Nerdwallet

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Your Paycheck Tax Withholdings And Payroll Deductions Explained

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Senior Payroll Administrator Resume Sample Mintresume

San Francisco Payroll And Gross Receipts Tax Liability 101 Youtube

Mosey Secures Fresh Capital To Help Companies Comply With Payroll Rules Techcrunch

3 11 13 Employment Tax Returns Internal Revenue Service

Local Income Taxes City And County Level Income And Wage Taxes Continue To Wane Tax Foundation